My Finance Agent App: Create a Budget

- Feb 12, 2024

- 3 min read

Updated: Sep 27, 2024

Give every dollar a job with the My Finance Agent App budget planner. The budget planner feature organises your budget into income and expense categories, extrapolates the categories into annual totals, and calculates your yearly budgeted surplus or deficit.

Grow your money muscles

You know how good nutrition is a key component of physical health? That's what budgeting is to financial wellbeing. A little budget planning goes a long way to making sure that your income is being used in a way that provides the right building blocks to grow money muscle.

The principle behind budgeting is to give every dollar a job. Some of your dollars will need to cover living expenses (eg. housing, transport, groceries etc.). Other dollars will need to perform future-proofing or protection tasks (eg. insurance and rainy day savings). Those are the essential jobs.

However, with the help of budgeting, the intention is to make sure there are dollars freed up to do more exciting jobs, such as achieve your financial goals (eg. house deposit, retirement), as well as fund the fun stuff (eg. holidays, entertainment, eating out).

Did you know... You may be closer to the goal of buying a home than you think. First home buyers need as little as a 5% deposit. Talk with us to find out more!

Budgeting for singles vs. couples

Budgeting for singles is especially important because singles tend to spend a higher proportion of their income on essential living costs. Without planning, this can leave little money for saving, and, without a saving safety net, you are more likely to experience financial stress.

While couples and families may have lower proportional living costs than singles, they are more likely to have higher discretionary costs. Couples can also have the added pressure of managing joint finances. Budget planning can be a great way to talk about your finances and get clear about your goals and priorities.

Tell your money what to do

The budget planner in the My Finance Agent App breaks your budgeted income and expenses into categories, extrapolates them into annual totals, and calculates your annual budgeted surplus or deficit.

A surplus (positive amount) indicates you have unbudgeted income left over. A deficit (minus amount) indicates that your budgeted expenses are higher than your budgeted income.

These are the living expense categories:

Rent

Rates

Utilities

Phone & internet

Home maintenance

Groceries

Medical and pharmacy

Clothes & shoes

Education

Pets

These are insurance and superannuation expense categories:

Life

Income protection

Health

Superannuation

Home and contents

Car

Business

Other (boat, caravan, trailer)

These are loans and credit card expense categories:

Mortgage

Personal loan repayments

Credit card repayments

Store card repayments

Other loan repayments

These are transport expense categories:

Vehicle

Maintenance

Petrol

Parking

Public transport

Other

These are leisure and entertainment expense categories:

Holidays

Restaurants and takeaways

Sport, hobbies, and memberships

Newspapers, magazines, and books

Gifts (Christmas, birthdays)

Other

Seeing your finances organised like this is a powerful reminder of how hard your money needs to work!

How to start with budgeting

In this previous article, we demonstrated how to access your expense analysis in the My Finance Agent App. The expense analysis summarises your spending - for those bank accounts and credit cards that are linked to it - into categories based on a rolling 30-day period. You can use that information to easily populate your budget planner.

Alternatively, you can populate the budget planner first and then compare it with your actual spending over the last 30 days. How do the budgeted amounts compare with actual? Are you spending more or less than you budgeted?

Looking at the annualised summary, is your budget in surplus or deficit? Which expense categories are costing you the most? Where could you trim costs? Is it possible to increase your income? The more dollars you have, the more jobs you can give them!

Ready to make your money work for you? Let's go!

YOUR MISSION:

Create your budget planner

Estimated time: 30 minutes

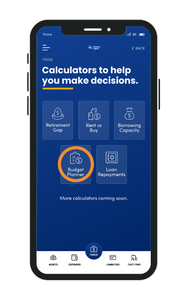

Select 'Tools' from the footer navigation

Select 'Calculators'

Select 'Budget Planner'

Scroll through income and expense categories; click to select

Enter amount and frequency (weekly, fortnightly, monthly, quarterly or annually) for each category

Scroll to bottom to see total annual surplus/deficit

7. [Optional] After completing your budget calculations, email them to yourself. To do that, click the email icon.

8. [Optional] Fill in the necessary details (your email address and name) and click send. It should land in your inbox shortly.

Jump to another app topic

Got a question?

You can open a tech support ticket or call our tech support team on 1300-143-456 during business hours.

Comments